Earn Money With A Supercar Investment? Fairy Tale or Reality?

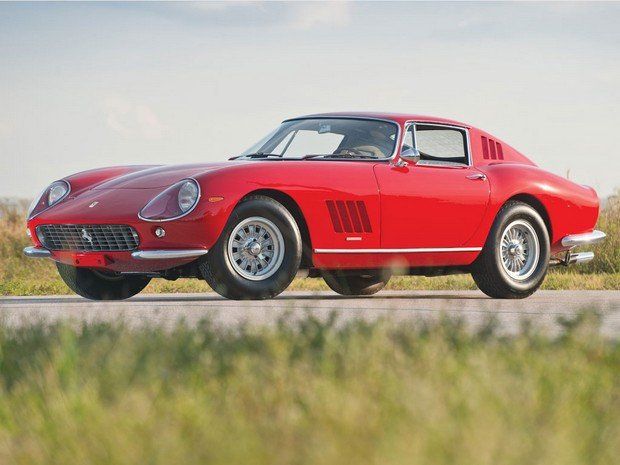

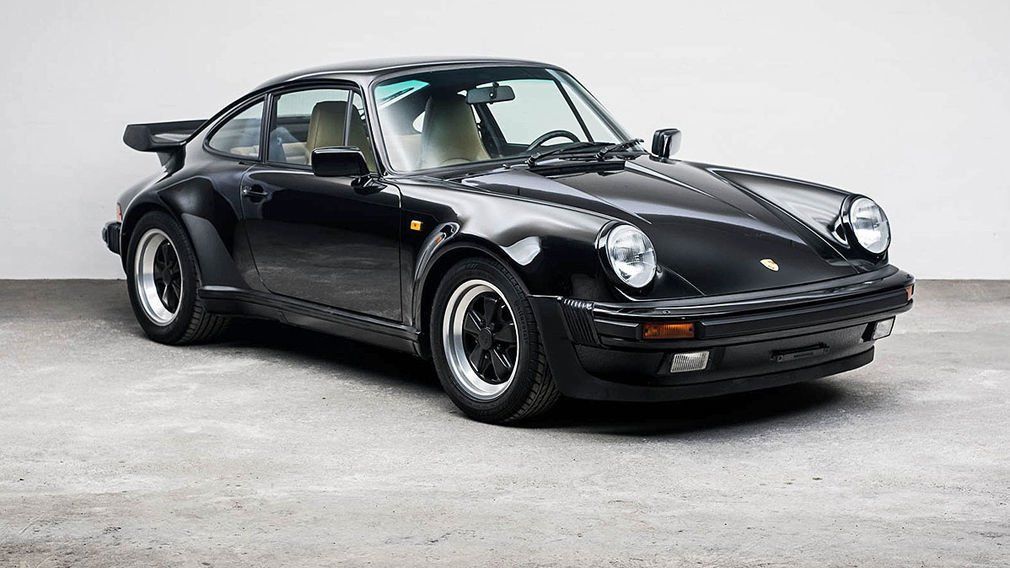

Investors are increasingly thinking about profitable alternatives that further diversify their portfolios and open up new markets. The current focus is particularly on supercars and classic cars for investors. For car enthusiasts, purchasing a supercar as an investment can be one of more rewarding ways to combine their passion with financial gains.

Making money investing in supercars is a very risky strategy, but can be also very lucrative.

As with all investment decisions, you should have in-depth knowledge of the specifics of the chosen vehicle and the reasons why this model should increase in value.

When it comes to buying supercars, it seems natural to think of it as a kind of investment decision. It may be hard to calculate the profit while driving a LaFerrari, but the facts speak for themselves: at the beginning of 2018, a 2016 Ferrari F12TdF was up for sale at Mecum auction for more than 1.07 Mio € with its original price of 0.55 Mio €.

"Provided that you have bought the right car

at the right time, you can expect extremely

lucrative returns that can hardly be achieved with

any other asset class."

Heiko Siemann (founder Siegacars)

Another great example is the LaFerrari Aperta delivered in 2018. All 202 supercars were for sale in 2016 with the manufacturer’s list price of 2 Mio €, but production slots were selling for more than double the price. Those who bought early slots at double the list price still made a handsome profit as the Aperta slots and early physical cars went on to make almost triple the list price.

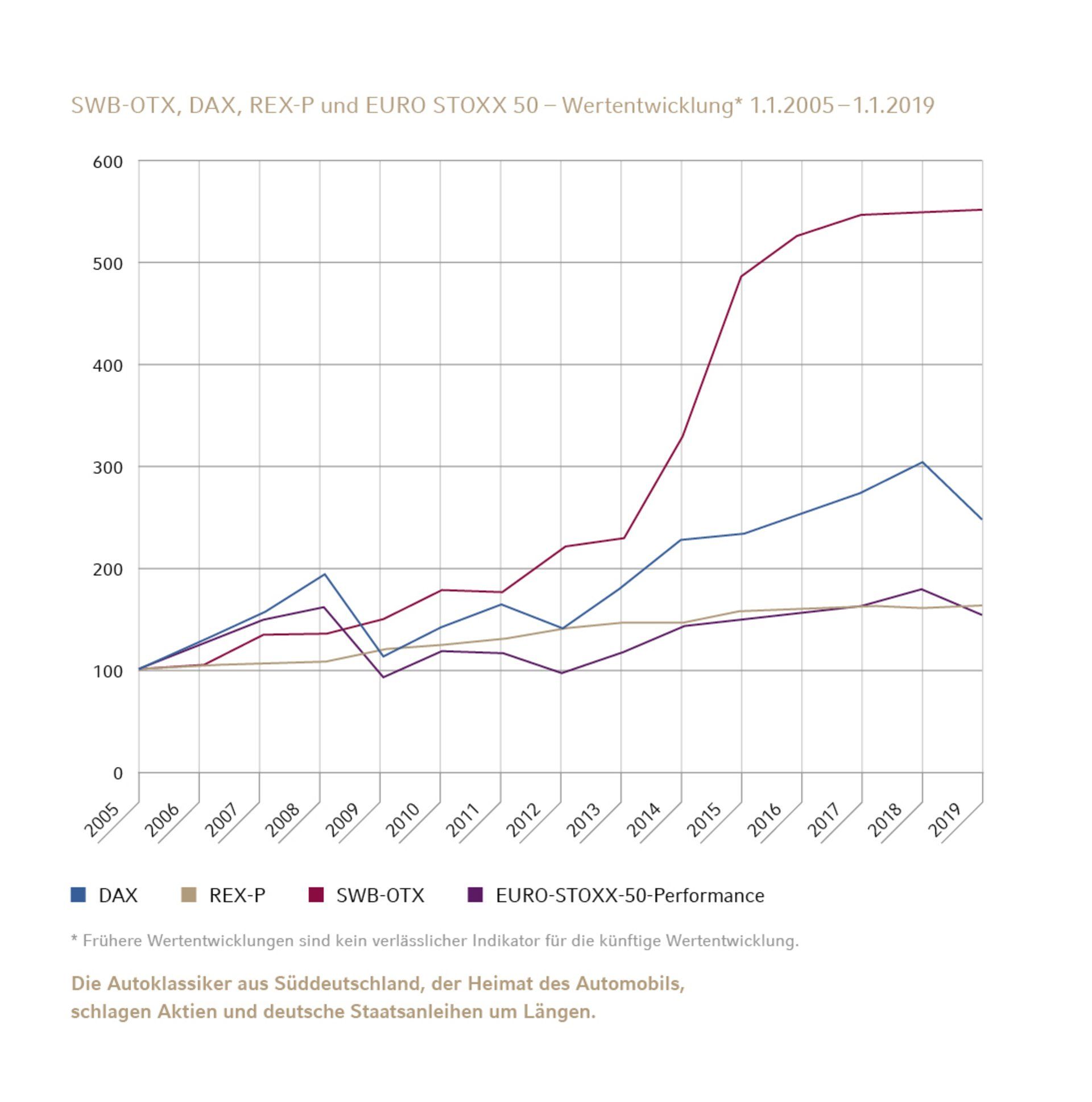

Acquiring and maintaining vehicles has so far been perceived as a hobby rather than an investment. A look at the DAX30 and the oldtimer index OTX shows that oldtimers and youngtimers are no longer just a hobby, but a serious form of investment. The continuously increasing profit development around investments in classic cars in the past years is proof of this. While the OTX continues to grow, the DAX30 performs much more volatilely in the same period.

A comparison of the two indices shows that the DAX30 rose by a total of 52% between 2000 and 2018. In parallel, the OTX shows growth of 161%.

Classic cars - Average ROI is more than interesting and currently increasing.

Is the investment value still promising?

We've picked some of the most interesting or iconic classic cars in an excellent condition and have compared the average market value in a 10y period (June 2010 - June 2020). In our analysis we found out, that the prices for super sports cars or rare classic cars are rising again since march 2020. In 2018 we saw an overheating and prices came back in 2019.

At the moment "High-net-worth individuals" (HNWI) are searching for alternative Investments due to the high volatility and nervousness in the stock market. The real estate business is still on a very high price level and so the capital is also moving into the classics & performance cars market.

The comparison shows: Investments in oldtimers and youngtimers wrongly lead to a niche existence. If you take your time and observe the market in peace, you can make an important contribution to the diversification of your own portfolio. New applications help to keep the portfolio management effort as low as possible and the increase in value through fully documented vehicle histories as high as possible. Before the current economic forecasts lead to investments in the automotive sector becoming more and more interesting for investors, investors can still buy vehicles in good condition at fair market prices in many places.

Please be aware, that the individual prices could differ a lot, depending on availability and demand of each model.

From passion to an investment

It all starts with a passion for a special car

Most of our clients started their investment in oldtimer or super sports cars with a passion for one model. They wanted to use, feel and enjoy their investment. Mostly the first intention was not to built a portfolio as an alternative to other investment classes. But over the years the passion grow stronger and stronger and they realized that besides of all emotions there are also rational reasons behind it.

OTX Oldtimer Index (Germany) from Südwestbank

The OTX shows the relative price movement for 20 models (german car manufactures) compared to shares like DAX and Eurostoxx 50, etc. and was invented by the Südwestbank in 2010 to give investors some support in their investment decisions.

Please be aware, that we don't give investment advice. We are not responsible for your investment decisions. We only try to support you to find the right decisions.