How To Make Money Investing In Supercars?

It's not a secret to make a return on your investment from a supercar or classic car purchase if you invest in a collectible car which had a limited production run.

The most exclusive manufacturers like Ferrari, McLaren, Bugatti, Lamborghini, Pagani, Porsche, etc. tend to only produce limited quantities of their most luxurious models.

One reason for this is the manufacturer knowing they will struggle to sell high numbers of their cars. Porsche did this with the 918 Spyder in the year 2010. They knew that due to its 768.026 € price tag it wouldn’t be a huge seller, so they limited production to just 918 cars. On the flip side, manufacturers may choose to limit production numbers for special edition cars. Looking at Porsche again, they did exactly this with the 911R. At the time the 911R was the sportiest version you could purchase when looking at the expansive 911 range. Despite this, and despite knowing it would sell unbelievably well they only ever made 991 models. It was sold out immediately. Currently Porsche is producing limited models every year. For example the Porsche Targa 4S Heritage will also be produced for 992 well selected "VIP-Clients". Rising prices are guaranteed.

By manufacturing a limited number of cars the supply level is capped. Over the years after production, demand for certain limited edition models can rise. This allows those who purchased a supercar at list price to sell their car for a much higher price, and therefor profiting from their investment.

Production Slots

When a car is announced and pre-production sales start, buyers will be given a production slot. This is the order in which the cars are manufactured. So if you purchased production slot 50, your car would be the 50th to roll off the production line.

Buying a production slot is the first step to secure your investment. Of course before getting too excited and purchasing a production slot for the next flashy supercar to be announced, you need to understand which supercars the demand will be greatest. What makes a supercar appreciate in value.

The rather shady practice of securing a slot, then selling it at an inflated price before production starts is generally frowned upon. Many manufacturers try to stop this practice from happening through various methods. McLaren for example ensure they have the first refusal to purchase the car back at the original list price if the buyer has changed his mind and didn’t want to proceed with purchasing the car.

Putting the selling of a build slot to one side, buying a build slot, taking delivery of the car and selling soon after, can lead to a nice yield.

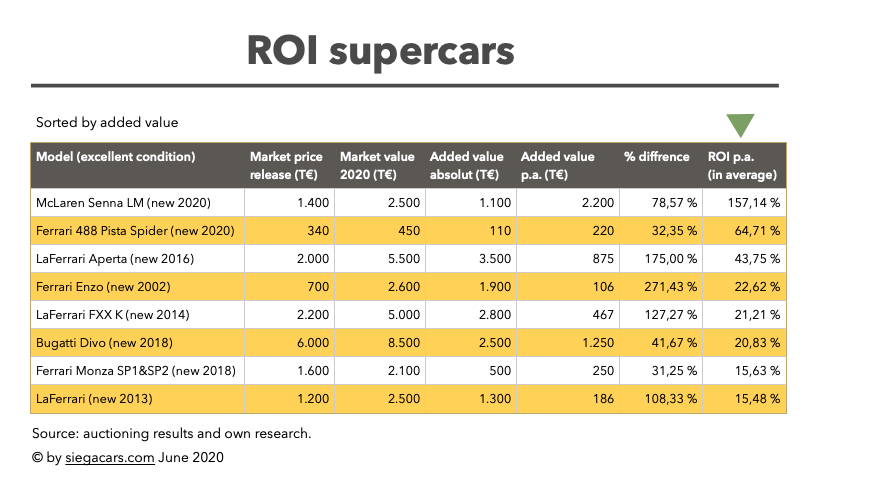

Putting this in to practice we just have to look at the recent Ferrari LaFerrari. It had a list price of 1.2 Mio € and now sells for 2.5 Mio € upwards.

Supercar Investment - Risky or Safe?

Like investing in other forms, investing in a super- or classic car does carry a few substantial risks.

Yes, if you get it right you can make a very good return on your supercar investment, however there are a few expenses to consider before purchasing.

What Are The Costs Of Keeping A Supercar?

If you want to keep your high value investment in excellent condition, you will be looking at storage costs for a safe garage. Along with this you’ll have on going annual costs such as regular servicing, maintenance and insurance.

On top of the expenses that you’ll have to factor in just to keep a classic car or supercar, there is also the chance that the car you have invested in doesn’t actually increase in value.

It is recommended to seek professional advice when choosing which supercar to invest in, as many will simply depreciate as soon as they roll out of the factory.

Examples Of Cars Which Have Lost & Gained Value

As an example, when the first Dodge Viper was unveiled, many investors purchased the aggressive 400bhp American sports car with the hopes that it would rapidly increase in price. Unfortunately this wasn’t the case.

The list price in the USA was roughly $50,000 back in the early 90’s. Today you can pick up these early models for less than $40,000. This yields a rather hefty loss when you factor in maintenance across the past 20 years along with inflation.

This single example goes to show that not every impressive looking supercar that rolls out of production is worthy of investment.

But for every Dodge Viper, there is also a Ferrari Enzo which has appreciated by over 4 times! From it’s initial 0.7 Mio € list price to almost 2.6 Mio €.

Ferarri luxury cars and supercars tend to outperform the value of premiums when coming up for sale, but companies like Koenigsegg and Pagani are climbing the charts with their Regera and Huayra Roadster models.

What Factors Lead To Supercars Appreciating

There a few factors to consider when weighing up which car you think will increase in value.

The Right Timing

There is a short window of opportunity for buying and selling for a big profit so when investing in production slots, timing is everything. Take the Ferrari F12 Tour de France that at its peak were selling for over 1.1 Mio €, but soon Ferrari will announce its replacement the Ferrari 812 Superfast TDF/GTO which will have a big impact on the F12 TDF with the value of the car dropping by as much as 40%.

Limited Quantities

Generally if a car has a very short production run, such as in the hundreds, this would be a great starting point.

With only a limited amount of cars going into a production, manufacturers will have queues around the block of potential buyers all looking to secure their production slot. Once the car has been manufactured and delivered, if any nearly new models pop up for sale, those who missed out the first time round will jump at the chance of finally purchasing their limited edition model. This can lead to the initial owner being able to sell their car for much more than the list price that they paid.

An extreme example is the Bugatti Divo. The production of the Divo is limited to 40 units and the car will be built alongside the Chiron at the Bugatti factory. All of the 40 cars were pre-sold before the public debut to Chiron owners through special invitation by the dealers.

Cars such as the McLaren Senna and the upcoming Aston Martin Valkyrie are sold out already and haven’t even been manufactured yet.

The McLaren Senna is limited to just 500 models and costs 0.98 Mio €. And the Aston Martin Valkyrie, which has been developed with the Red Bull Racing formula 1 team, is being limited to just 150 production models.

Both of these cars are expected to appreciate very quickly once the production models become available in the almost new market.

Historical Importance

When looking at classic supercars to consider for purchasing as an auto investment, historical importance can be a winning formula.

Cars to consider could be the Jaguar E-Type which was pioneering in the 1960’s. It brung a host of technological improvements, extraordinary and a competitive price tag.